Strategy plans

Strategy plans · 22. November 2024

In this geopolitical environment, the most obvious strategy in Forex is short EUR/JPY. Setup: ECB needs to keep lowering interest rates and on the other hand, BOJ needs to keep raising interest rates... This can take the pair to the 150 and even 140 range at some point in mid- to late 2025. Here you have the clearest trend in these timeframes in Forex, barring political events that turn the situation around.

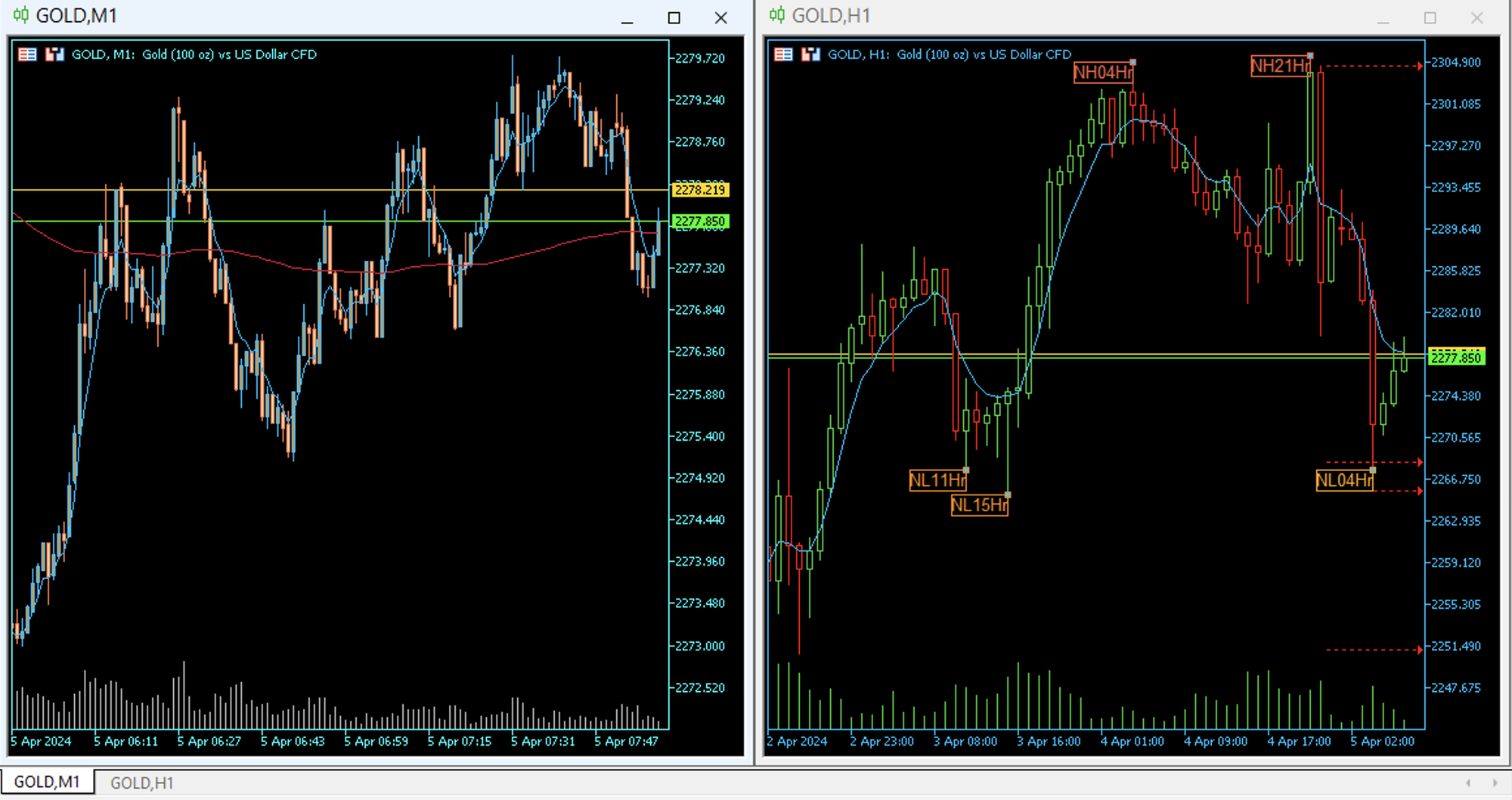

Strategy plans · 05. April 2024

It's time for gold and the pullback strategy for New Hight New Low intraday is working for me. I set alarms at those points and put a pending order looking for the rebound, if it occurs, the previous day's Schedules are helpful. Stop Loss a little above or below the NH NL respectively.

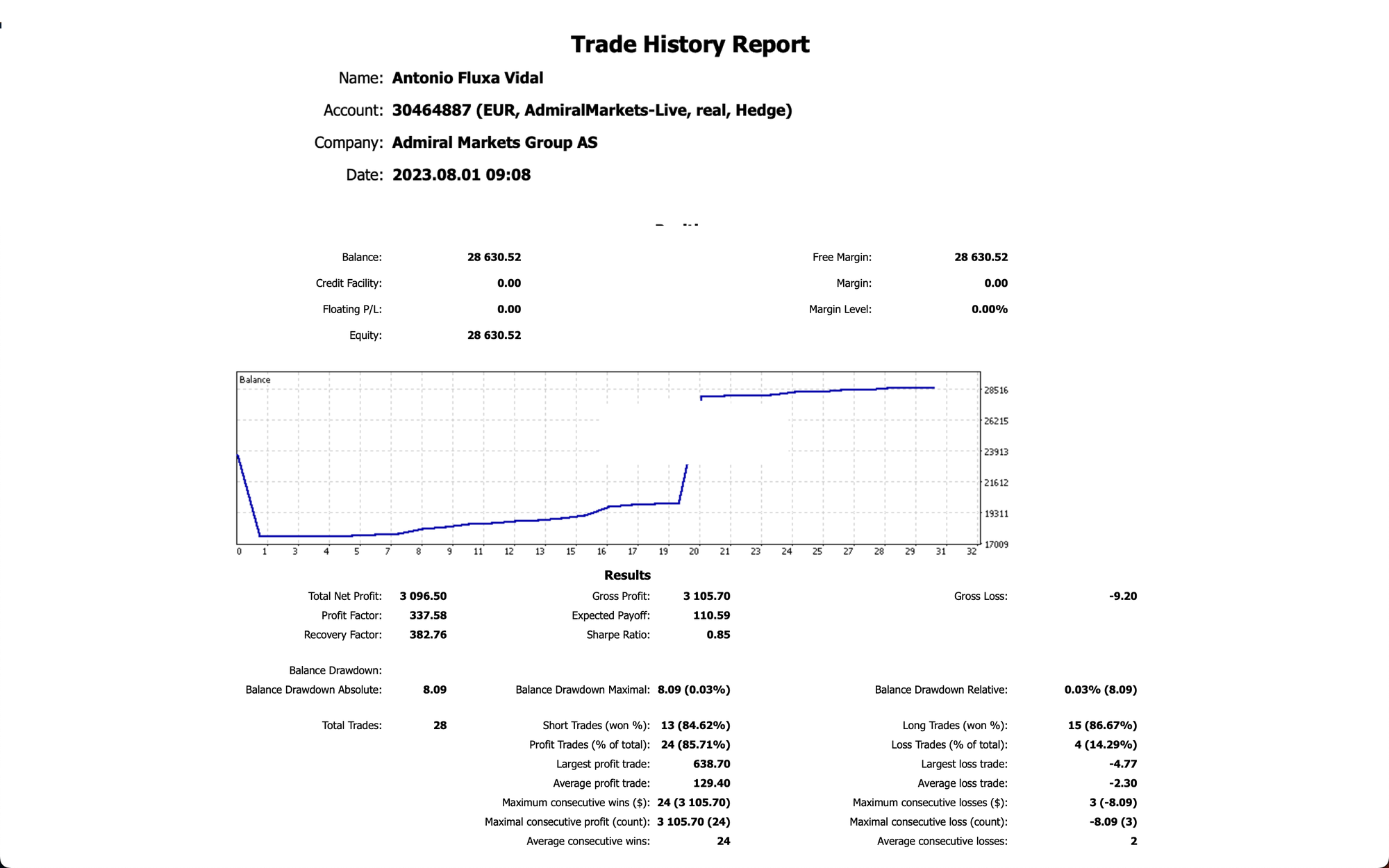

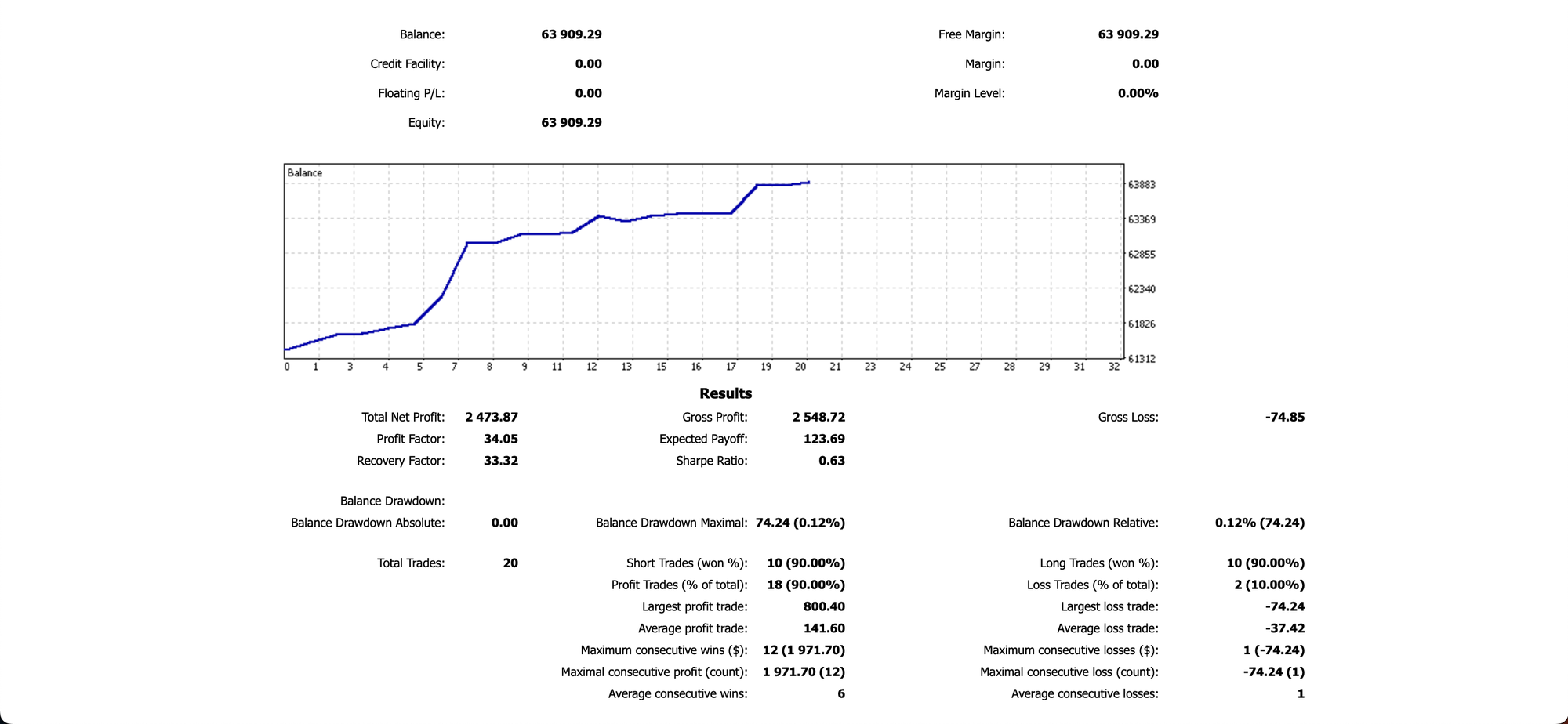

Strategy plans · 01. August 2023

My monthly report. based on my strategy of correction of violent impulses I have obtained in 28 operations:: 24 winning operations against 2 losing operations, a Drawdown of only 0.03% A Sharpe Ratio of 0.85 which indicates a robust commercial strategy.

Strategy plans · 21. June 2023

RUT Russell 2000 Forecast of strong fall towards the fourth quarter of 2023

Setup: Renewal of loans to mid to low capitalization companies for the fourth quarter with the new interest rates.

Despite being a medium-long term forecast, it is more than evident what will happen with this index and others.

Strategy plans · 20. January 2023

I have built a 100% free and functional Expert Robot visit the A.Intelligence page

Strategy plans · 14. December 2022

And indeed. Inflationary data was published below the estimate. Now the FED can slow down the increase in interest rates. Very good for the economy in general.

Strategy plans · 13. December 2022

To all Forex traders:

Short-term fundamental analysis.

Next Wednesday, the Fed's macroeconomic data on interest rate hikes will be published.

The news so far is that very high inflation data would have to be obtained for the Fed to publish a higher-than-expected increase.

The outlook from now on framework data for the USDX (Dollar index) is bearish, therefore it should be under the perspective of bullish fundamental data for foreign currencies.

We try to get the impulses in zone breakouts.

Strategy plans · 21. September 2022

Before New Intesrest Rate USD Index brick a resistance and go up.

Yes, you can contact me: Your opinion interests me. You can talk to me in English, Spanish, German or Italian.

email: tonifluxa@gmail.com

Telegram: https://t.me/tonitrading

Jimdo

You can do it, too! Sign up for free now at https://www.jimdo.com